Hall of Shame 1982 Action Handbook

Primary Source

2012 Introduction

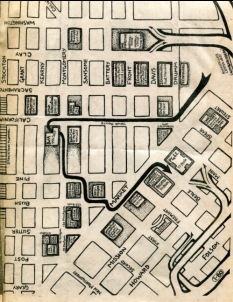

In 1982, the Abalone Alliance organized a tour of the city's corporations that had nuclear power and weapons links. Over a thousand activists toured the corporations in downtown. As part of the action, an 8 page action manual was put together. It included maps and information about corporations from Bechtel, PG&E, Wells Fargo and many more. Below is a scanned in copy of the original action handbook, including images. FoundSF did an excellent article on the Hall of Shame tour that includes photos from the event. The Hall of Shame concept would be copied again by activists in July 1984 when the national Democratic Convention came to San Francisco, that took place during an entire week, resulting in hundreds of arrests. Here's a link on SF/Cal Corporate history for more on mega corporations in San Francisco.

Collective Statement

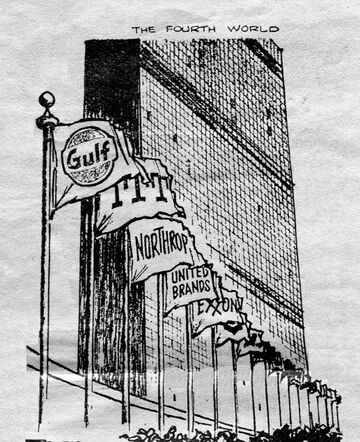

To say that a handful of gigantic corporations and government agencies have conspired to bring us all to the brink of apocalypse for the sake of their personal careers and pocketbooks is an amazing accusation. But just take a close look at the front page of the Wall Street Journal for the latest faces in the President's cabinet. The evidence is overwhelming. It is so obvious, in fact that the real question is: why isn't it common knowledge? Clearly, most of us would rather not think about it too much. That's understandable. We usually feel that way ourselves. There are more enjoyable, things to do than contemplate the power-drunk anti-nature sub-culture that controls our society. But things are so out of hand that we feel compelled to think about these things and to act on what we learn.

Here is what we've learned. There is a pattern. These same corporations are dishonest they are racist they are sexist they co-opt the unions they can't break, they are war profiteers, they invest more and profit more each year from the third world, they are major polluters and many of their workers are dying from unsafe conditions and procedures. And these corporations—with their twin brother the government—dominate our economic and political lives.

One note of encouragement though: their very greed and arrogance may be their downfall. Even the gigantic corporations are made up of individuals who are finding fewer and fewer other individuals willing to cooperate in grandiose schemes for profitable destruction. The more we expose the monumental waste and stupidity of the nuclear cycle of death, the more we rely on our own consciences and ability to create alternatives, the more we reject arbitrary exercise of authority by those whose only power lies in fast-disappearing public apathy, the sooner we will close the Hall of Shame and take on the challenge of building a nuclear-free World.

Rockefeller Empire, Rockefeller Center West

Actually, it was decided at the last minute to call it Embarcadero Center instead of Rockefeller Center West. Californians are so proud. But David Rockefeller was given 25% of the center in return for 1% of the investment "and his good name". The Rockefeller Interests is one of the most powerful institutions in the country. They have major investments in many of the nuclear corporations on the tour. Ironically though, none of the main Rockefeller corporations are represented on our tour because they've chosen L.A. for their western headquarters, (This includes Atlantic Richfield and Chase Manhattan Bank.) But it is only relative. There are many Rockefeller signs in San Francisco and not just Rockefeller/Embarcadero plaza or the Rockefeller Center Construction Co. up at 244 Pine.

For example, the influential Rockefeller Foundation that has given over $1.5 billion in its existence has recently chosen a trustee from San Francisco. His name is Herman Gallegos. Mr. Gallegos is also a trustee of Pacific Telegraph and Telephone. This is nice since PT&T is practically a sister corporation to PG&E; noted by the three directors the two companies share. Nor is this the only Rockefeller tie to PG&E, The Foundation's director for International Affairs recently became vice-president of PG&E for corporate planning.

Rockefellers deserve a whole book, not just these few paragraphs. There isn't space to talk about their numerous institutions (Trilateral Commission, Council of Foreign Affairs),' projects (The Urban League, Rockefeller University), or companies (Exxon, United Nuclear). Let's just be thankful that there is only one Rockefeller Center, . .at least in name.

General Electric, 2 Embarcadero

"GE brings good things to life!"

"Progress is our most important product!"

SIZE: Profits of $1.5 billion on sales of $24.9 billion in 1980.

PRODUCTS: GE makes steam turbines, locomotives (80% of South Africa's for example), nuclear reactors, jet engines, lightbulbs, machine guns, missile launch systems, a refrigerator with 63 separate electricity-burning components, and factory robots. Through its GE Credit Corp. (another major nuclear financier), it makes money on money ($80 million in 1980). GE owns radio and TV stations; they just about own Schenectady, NY; they bought Utah International (coal and uranium mining) for $2.2 billion; they are seeking to patent gentically-engineered life forms, find a way to use fingerprints as credit cards, and GE knows what else. GE provided police equipment and training to the Shah's (Iran) infamous SAVAK police.

WHO CONTROLS: GE is run by professional managers and bankers. Large institutions—bank trust departments, insurance companies, pension funds, investment firms—control 20% of the stock. The largest shareholder is Morgan Guaranty which boasts three GE directors. Other directors include the president of Citibank and the president of Utah International who also sits on the board of Wells Fargo.

FRIENDS & INFLUENTIAL PEOPLE: Before our showbiz president (Reagan) made it to the top of the acting world, he spent eight years as a mouthpiece for GE as host of its weekly General Electric Theater TV show. Several times a year Reagan toured GE plants offering insights on the evils of "the swiftly rising tide of collectivism." Reagan's chief science consultant is Arthur Bueche, ex-GE senior VP for technology. Recently GE's board of directors included an Air Force advisor, a Secretary of the Army, and two Secretaries of Defense. Three current board members are also members of the Trilateral Commission. When you're as big as GE you've got to have friends everywhere. That is why of 429 NRC officials studied by Common Cause, GE topped the list with 34 former employees. (105 came from other nuclear corporations.)

SCANDALS: GE's history is one of greed, growth, and war profiteering. When in 1961 it was indicted as ringleader of a massive conspiracy to fix prices, rig bids, and divide markets in the $1.75 billion electrical equipment industry, one jailbound GE exec explained, "Sure, collusion was illegal, but it wasn't unethical.

This insight into business ethics may explain another GE skeleton. While the Nazis bombed England, GE conspired with Germany's largest defense corporation (Krupp) to fix prices and control trade; after they were indicted by the U.S. government in 1948, the price of one hard metal crucial to the war effort fell from $453/lb. to $40/lb. These kinds of activities caused GE's sales to increase by nearly 400%, from $340 million to $1.3 billion between 1940 and 1942. A Fortune Magazine article from 1942 blithely states: "Last year...it made some $100 million worth of household appliances; by the end of 1942 practically all of them will be replaced by lethal appliances...It was only natural for these engineer-managers to regard the war almost as if it was primarily another phase in the company's history."

GE was also intimately involved in the Manhattan Project and was rewarded with a $945 milllion contract for plutonium production at Hanford, WA. GE now ranks third among corporations which profit from defense spending, and is seventh among arms exporters. With the rate of profit in the weapons industry currently above 19% (highest for any U.S. industry), we might paraphrase GE: "Death is our most important product." GE has been involved in almost every major missile system—Poseidon, Polaris, Trident, the Minuteman Ml MIRV. At the trial of the "Ploughshares Eight", a group of catholics who went into a GE factory and beat oh some missiles with hammers, the judge consistently found that expert testimony on nuclear war was inadmissable; finally a frustrated onlooker shouted, "How do you find GE for building genocidal weapons?" The judge had no comment on that but he did sentence the protesters to federal prison.

Security Pacific, 1 Embarcadero (consumed by BofA)

A major investor in PG&E and Union Carbide, Security Pacific isn't in the same league as B of A, Wells Fargo, or Morgan Trust, but they are representative of the important role the middle-weight banks play in the nuclear system. $22 billion in deposits.

Capital Research & Management Capital Group, Inc., Capital Guardian Trust Co., 2 Embarcadero

Sort of a shy group. It took hours of research to find out very little about this (apparently) Los Angeles based group of investors who have huge holdings in DuPont (6th biggest shareholder), GE (20th), Kerr-McGee (5th), and Union Carbide (8th). Apparently, Jon Lovelace (b. 1927, Princeton) heads the group and American Mutual, Investment Co. of America, and New Perspective Fund. There is still lots to find out. Hopefully by March 22 we'll have more details.

First National Boston Corporation, 2 Embarcadero

This enthusiastic investor in nuclear projects is a case study in regional banks. $16 billion in assets, 11,000 employees, and a Board of Directors that almost runs New England itself. It includes the Chairman of Stone & Webster, the New England behemoth-builders of Seabrook; the Chairman of Boston Edison (Pilgrim nuke), the President of Boston College, the President of New England Electric, the head of Massachusetts General Hospital, the President of Masssachusetts Mutual Life and the leaders of other New England giants like Wang Computer Labs, Raytheon (number three nuke constructor) and Gillette. Merged out of existence as a result of the removal of the Glass-Steagall Act in 1998.

Merrill Lynch and Co., 1 Maritime Plaza, 1 Embarcadero

"The firm that brought Wall St. to Main St."

SIZE: The "broker of the little guy" is the biggest brokerage house in the world and a major investor in nuclear corporations. Merrill Lynch's 26,000 employees working for "People's Capitalism" yearly bring in over two million customers to 400 plus offices generating over $100 million in reported profits on $2 billion in sales. ,

PRODUCTS: "It's a bank in disguise" whines David Rockefeller, who is jealous of their brokerage business. With recent expansions planned for their real estate division (20,000 agents by 1983), Merrill Lynch will become a triple threat: investment bank, stockbroker, and real estate speculator.

FRIENDS OF MERRILL LYNCH: Pres. Reagan's Sec. of the Treasury is, Donald Regan, the last president of Merrill Lynch. Nixon's Sec. of State, Rogers, is a Merrill Lynch director. So is the ex-president of the NY Stock Exchange and the ex-editor of Time and also a former Commandant of the U.S. Marine Corp.

SCANDALS': Merrill Lynch's very existence is a scandal. They don't contribute anything to our society. 1 All their operations are parasitic or worse.

Come to the Hall of Shame to find out why the Merrill Lynch bull went from being "Bullish on America" to being "A Breed Apart". How much does this bull make per commercial anyway? Merged out of existence.

Brown & Root, One Market Plaza

This Texas construction giant ($5 billion, 65,000 employees) does a lot of nuclear business. In 1978, they were the sixth most active nuclear engineering and construction firm in the country. But they're independent no more; they've been bought by Halliburton Co., an oil equipment company that weighs in at over $8 billion a year, with 110,000 employees. The chairman of Halliburton sits on the board of Citicorp/Citibank. On Halliburton's board are numerous rich Texans and also William Simon (Secretary of the Treasury under Nixon) and Anne Armstrong, friend of the Shah and Ambassador to the Court of St. James (Great Britain) for her good friend, Richard Nixon.

J.Ray McDermott (Babcock & Wilcox), 1 California

Sales: $3.6 billion; Profits: $106 million; Employees: 59,000

J, Ray McDermott constructs huge off shore oil-rigs—like the one that collapsed recently off the George's Bank. Babcock and Wilcox make coal plants but they're famous for the nuclear accidents— oops—reactors. Who controls the company? McDermott's board has been described as "free-wheeling, entrepreneurial bosses known for their aggressiveness" (see Scandals); their head, J.E. Cunningham (ex-Fluor Corp.), looks forward to integrating Babcock and Wilcox's "sophisticated management tools".

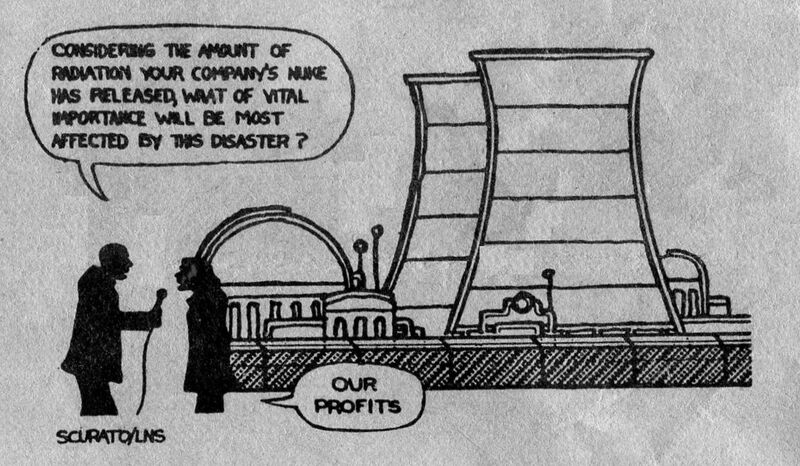

SCANDALS: McDermott (with Brown and Root Corp.) has a hammerlock on the offshore construction of oil rigs—which the oil companies, principal customers, encourage. In 1979, both companies were convicted of price-fixing: four McDermott executives were fined $282,000, given 12-36 months suspended sentences. The Securities and Exchange Commission, not to be outdone, fined the company $1 million for such shady practices as racketeering and illegal political contributions. How did Cunningham—chief financial officer—escape indictment? "Cunningham's role was always murky/' Business Week quoted one source. McDermott bought Babcock and Wilcox because the oil rig biz was in serious decline—on recommendation of the sage Stanford Research Institute. But with demand for electric power slowing, and utilities in bad financial shape, B&W may follow its ailing parent. B&W, of course, built Three Mile Island, and they haven't recovered yet: the company faces $560 million in lawsuits, and their anticipated $2.4 billion in nuclear construction is in jeapardy. The suit, which accuses B&W of "gross and wanton negligence", refers to a similar accident in 1977 at a B&W nuke owned by Toledo Edison; there, B&W technical personnel allegedly recommended that some safety defects not be reported to the NRC "because of fear of overreaction".

McDermott's response to TMI? Cunningham: "We're pulling back from commercial work to concentrate on federal programs." Where, apparently, negligence is the standard. But B&W's expertise now has a permanent memorial: the 203 foot tall containment building filled with radioactive krypton gas. Inside, the 7 feet of water is constantly evaporating and condensing at the top of the building—so a constant radioactive rain falls inside. This is matched by a less visible legacy, described bv Dr. Ernest Sternglass: the rise in infant deaths following release of the plant's radioactive gas-cloud. The "accident" isn't over, either; so far three systems built to clean the plant have failed, and no one's sure how to remove either the gas or the water. Presently, a pump keeps the pressure inside the containment building iess-than-atmospheric. Residents pray that the two construction companies keep that pump working; meanwhile, they monitor the plant with their own geiger counters. They can't forget.

Union Pacific Railroad, One California (purchased Southern Pacific RR 1986)

Sales: $4 billion; Employees: 30,367

The history of the scoundrelry and thievery of the railroad land grab of 1864 is no secret. The US government was so desperate in the mid-1800's to connect the east and west coasts (especially after the California goldrush) that they offered anyone willing to build a railroad 20 square miles of land for every mile of track laid in "The Great American Desert" (the area of Kansas, Nebraska, Wyoming and Colorado). Sometimes land was just stolen at gunpoint, or taken by "eminent domain". When Union Pacific Railroad joined track with Central Pacific, completing the East-West railroad line in 1869, Union Pacific had acquired 7 million acres of land, an area the size of New Hampshire and Vermont, and though they sold much of the "surface" land in the years since, they still retain the mineral rights.

Railroading (mostly freight) accounts for only half of Union Pacific's business; the rest comes from the vast mineral resources that lie beneath their land. Besides their coal reserves (17 million tons per year), their numerous gas and oil wells and refineries, Union Pacific also has a fast growing uranium business. Their mines and mills process more than 1,000 tons of uranium per day, which they sell to Southern California Edison and San Diego Electric, and they are involved, with Southern California Edison, in a $20,000,000 joint venture for uranium development in Wyoming.

Until 1974, Union Pacific was controlled by the renowned Harriman robber baron clan and Eldridge T. Gerry, Harriman's grandson, sat on the board until recently. Other interesting interlocks: Oscar T. Lawler, a Union Pacific director is the retired chairman of Security Pacific National Bank. Brigham Young once served on the board, and Salt Lake City is now represented by George S. Eccles, the largest shareholder in the company, who is (surprise, surprise!) Chairman of First Security Bank of Salt Lake City, and by his nephew, Spencer F. Eccles, President of the bank.

Union Carbide, 1 California

- "An unwieldly giant run amok, plunging into often mindless new ventures.."

- —The Wall St. Journal

- "A reactionary ogre obsessed with profits!"

- —Fortune Magazine

SIZE: The 34th largest corporation in the U.S. 18th largest uranium reserves. No. 1 in garbage bags worldwide. Union Carbide has over 500 factories in 45 countries around the world employing over 116,000 workers. In 1981, these workers generated over half a billion dollars profit on sales of over $9 billion.

PRODUCTS: Over 800 chemicals, hundreds of plastics, specialty gases; oxygen and nitrogen. Mine, enrich and process uranium; manage the Oak Ridge Labs (nuclear weapons and power) for the U.S. government, and for the consumer they make Prestone antifreeze, Simonize wax, Everready batteries, and Glad bags.

FRIENDS AND OWNERS IN HIGH PLACES: Union Carbide is considered part of the Morgan Group. They are interlocked with key corporations like GE/Utah International, Metropolitan Life, Rockwell Int., and the U.S. government. Ex-head of the Environmental Protection Agency Russel Train now sells his expertise (and connections) to Union Carbide. The flow goes the other way of course. Union Carbide's Union Carbide's president Rush left the company to serve in the Nixon administration as a Deputy Sec. of State and of Defense.

UNION CARBIDE IN THE PUBLIC EYE: Union Carbide has staked a claim in the Black Hills. They want to strip-mine Craven Canyon and then use open-air leaching to extract enriched ore to make nuclear weapons and fuel.

They own Vanadium Corp. which owns the Monument Valley Uranium Mine which is on Navajo land in Arizona. Hundreds of Navajo people have been exposed to radioactive and other pollutants.

They are a major corporation in South Africa where they produce 20% of the apartheid regime's chrome. Union Carbide has also helped train South Africa's nuclear technicians. Under Union Carbide management, one government enrichment plant in Kentucky has misplaced over 11,000 pounds of uranium. In Indonesia, a Union Carbide battery plant is such a health hazard that their doctor resigned in protest. The plant stays open and the majority of the workers there are seriously ill.

AT THE HALL OF SHAME TOUR you'll learn more about this exciting company and such enigmas as:

- — "Studd, chaste, and tightspot"

- — "The smokiest factory in the world." -

- — "Pres. Bongo, Baron Guy de Rothschild, and that 7 year tax holiday in Gabon."

DuPont, 50 California

Sales: $32 billion; Profits: $1.7 billion; Employees: 171,000

What do they make? DuPont is the nation's oldest and most successful munitions industry, a company that has "waxed gloriously fat on war." They supplied 40% of all explosives used by the Allies in WW I, thereby earning more in those four years than it had earned in 126 years of peacetime business. They also make industrial chemicals, pharmaceuticals, agrichemicals, dyes and fibers. A significant part of this work is heading overseas; DuPont is in 26 countries worldwide, in search of cheap labor. Their big nuclear venture: designing, building, and running the giant facility for plutonium waste reprocessing and storage on South Carolina's Savannah River. When they built it in 1956, it cost twice as much as the total value of all plants and facilities owned by DuPont at the time. This information is highlighted in a popular book of the time: Atomic Energy For Your Business: Today's Key for Tomorrow's Profits.

WHO CONTROLS? DuPont is still controlled by the DuPont family, with the help of board members who chair MIT, head AT&T, and run the Wilmington Trust Co. A more relevant question: who do the DuPonts control? In Gerald Colby Zilg's brilliant DuPont: Behind the Nylon Curtain, the family is fortunate enough to have its own state: Delaware. They control both state and local government, its major newspapers, radio and TV stations, universities and colleges, largest banks and industries. When you include the family's holdings, they employ over 75% of the state's labor force. The family holds a staggering $150 billion in assets in corporations like GM (which they directly controlled for years), Uniroyal, Remington Arms, Phillips Petroleum, Boeing, and North American Rockwell. In the last 25 years, DuPont lieutenants have served as U.S. representatives and senators, attorney general, secretaries of defense, directors of the CIA and even Supreme Court justices.

DuPont's new head recently announced that DuPont would try to "get off oil dependence" — two months later the company purchased 55% of Conoco Oil's stock in the biggest takeover in corporate history: $7.5 billion. Morgan Stanley and First Boston stand to make as much as $15 million apiece just in finder's fees! .

SCANDALS: DuPont's history of scandals now includes the attempt to suppress the history of their scandals. They are being sued by author Zilg, for $5 million. Why? The publisher, Prentice-Hall, leaked an advance copy of the critical book to a Delaware bookstore with DuPont connections; subsequently, DuPont pressured the Book of the Month Club, who killed plans to issue the book to their members. Then Prentice-Hall reduced the printing, refused to advertise the book, and despite rave reviews, allowed the book to go out of stock just as demand was peaking.

DuPont's motto is, "There's a world of things we're doing something about." Zilg describes that world: "The Armorers of the Republic," as they like to call themselves, have helped drive America into world war, sabotaged world disarmament conferences, built deadly arsenals of atomic weapons and nerve gas, flirted with Nazis, and...were even implicated in an attempt to overthrow the US Government—at the same time managing to avoid paying their share of taxes." VP Henry DuPont summed up DuPont's attitude toward war and profits in 1954: "National Security must not be auctioned off to the lowest bidder...There are no bargains in the safeguarding of our freedom." The family's varied corporate interests grossed over $15 billion in war contracts between 1964 and '72, including the development of napalm and the powder that jammed M-16 rifles during combat.

E.F. Hutton, 400 California

"When E.F. Hutton talks, people listen." This is especially true now; the chairman of E.F. Hutton, Mr. John Shad, has been appointed by Pres. Reagan to be the new head of the Securities Exchange Commission (SEC) which oversees the stock market, other securities and commodities markets, and stockbrokers like...E.F. Hutton.

E.F. Hutton is pretty big: Over a billion dollars in assets, 11,000 employees, almost three hundred offices to sell nuclear corporate stocks or to set up investment/tax shelters for the rich. Among their more creative programs is, using a new law, E.F. Hutton can buy tax benefits from one company and sell them to another. The companies benefit, E.F. Hutton benefits, and the taxpayers lose out.

E. F. Hutton is also dealing with the failure of their subsidiary DNA, Inc. Designed to commercialize biotechnology, it has become the "conspicuous first casualty" in the commercial gene-splicing derby, according to Science. But the collapse of their 50 million investment "is a blessing in disguise"; now they're turning it into a tax shelter. E.F. Hutton is the largest dealer in tax shelters, a $700 million dollar a year business. Soon biotechnology failures will take its place next to oil and gas drilling, real estate, race horses, and fake farms like Reagan has.

Westinghouse, 1 Maritime Plaza (Alcoa Bldg., Clay & Front Sts.)

Sales: $8.5 billion Profits: $490 million; Employees: 141,776

Westinghouse didn't build Three Mile Island—but over the past decade they've done their best to make up for it. Unsafe train-control systems for BART, token uranium contracts, and not one, but two, nuclear power plants built on earthquake faults have given new meaning to their slogan, "You can be sure...if it's Westinghouse." The company "went clear" in a big way—they quickly gained 40% of the reactor market—but lost a big chunk of the turbine business to GE when theirs proved defective, then came the infamous uranium fiasco. Westinghouse had promised utilities millions of pounds of uranium fuel at the mid-60's price of $9.50/lb. But by 1975, the price had soared to $40/lb., and Westinghouse was forced to admit that they would be unable to honor their contracts. 17 angry utilities sued; by 1980, 16 had settled at a cost of $1.5 billion to the company. Westinghouse then sued 12 domestic and 17 foreign companies, claiming that the firms illegally forced the uranium cartel to push up the price. So far, Homestake Mining and Gulf Oil have settled, the latter at $25 million.

Their biggest nuclear scandals may be future quakes. They built (designed) the Diablo Canyon reactor, and are trying to build a $1.1 billion nuke in the Philippines. Diablo is near the Hosgri Fault, but count your blessings—the Philippine plant is on the slope of an active volcano, (the plan was stopped after Marcos was overthrown, but has resurfaced again) subject to both earthquakes and tidal waves. How did they do it? A close friend of the Philippine dictator admits receiving a $35 million fee "for his help in obtaining the contract." The NRC recently approved the deal, and a Philippine Energy Minister is optimistic that work will resume— with only a $500 million cost overrun.

Clearly, Westinghouse is a behemoth in trouble. Once No. 1 in exporting reactors, they haven't had an order since '77. Recently they closed a reactor plant in Florida. So where are they headed? Diversification: they own real estate (Half Moon Bay), construction, and added Teleprompter to their 5 TV and 9 radio stations. But their new emphasis is defense. They just invested $100 million in their Baltimore Defense Center, and their Defense Group cleared $1 billion in 1980. Some of their products: parts for the MX missile, AWACS radar, and Trident launch systems.

But Westinghouse has more than guns up its sleeve. Fortune Magazine (June '81) announced: "Westinghouse's Cultural Revolution". Bosses in construction "don't issue orders—they seek consensuses." Did they get it from the Abalone Alliance? At the Diablo Blockade? No, but close—they're copying Japanese corporations by introducing "facilitators, quality circles, and synergy". One legal counsel was hooted down by employees when he asked for a vote! VP William Coated explains the decision-making shift: "The old way wasn't good enough. Industrial systems have become much too complicated for the know-it-all manager to know it all anymore." Note that Westinghouse's nuclear division was sold to Japan in the last decade.

BanCal TriState (Bank of California), 400 California

- "I like to buy when no one else is buying. I like to buy when there's blood in the streets"

- —Baron Guy de Rothschild

Well the Baron is back in France but E. de Rothschild sits on BanCal's board and many people say BanCal speaks as much for the Rothschilds as their office over at 555 California. But this is probably unfair. The Rothschilds have a lot more going for them than BanCal. Well they should, they are probably one of the most powerful families in the world. Among the many Rothschild holdings are RioTinto Zinc, the world-wide mining company that controls the biggest uranium mining companies in Australia, France, Nigeria and Gabon (in a consortium with Union Carbide) among other places.

Little of BanCal is more than their Rothschild connection even if they only have $3.8 billion in assets and barely over 3,000 employees. Shirley Temple is a director after all. They have several interlocks with PG&E including the ex-chair of BanCal who is a PG&E director. BanCal manages the PG&E employees' fund, the company's single biggest stockholder. Price Waterhouse does their accounting.

Note Bank of California/BanCal TriState has been gobbled up 2 more times and is now part of the world's largest banking empire.

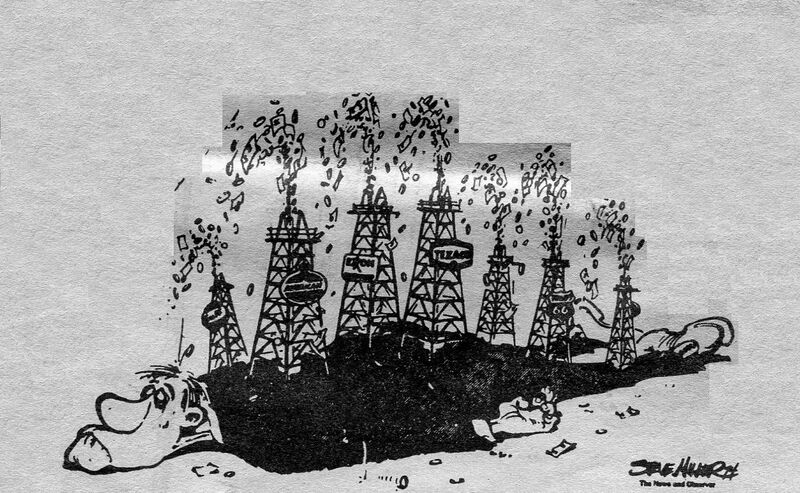

Wells Fargo, 464 California

If it weren't for enthusiastic investors like Wells Fargo, there might not even be a Nuclear Hall of Shame! PG&E is only one of the 32 major nuclear corporations in which Wells Fargo has big money invested. Throughout the nuclear cycle—from uranium mining and milling to enrichment; from reactor, component and weapons manufacturing to plant construction; from engineering and operation to fuel reprocessing to waste transportation and storage—Wells Fargo is there to lend a high-interest hand and reap the profits of its investments in Hall of Shamers like GE, US Steel, and DuPont. Even given assets of $23 billion, this is a pretty focused investment portfolio? It pays too: in 1981, Wells Fargo "earned" over $240 million in profits. Not bad for just 17,460 employees—of course interest rates in excess of 20% probably helped too!

Whether the money goes from PG&E to Wells Fargo in interest and dividends, or from Wells Fargo to PG&E in loans, it's the same guys running both corporations. Just as a bank looks after its investments, since Bechtel and PG&E bank with Wells Fargo, it's only right that the president of Bechtel sits on the Wells Fargo board too; or that Wells Fargo chairman Richard Cooley also sits on the PG&E Board of Directors. Wells Fargo director Ernie Arbuckle not only sits on the boards of the World Bank, Utah International, Stanford University, and Hewlet-Packard, but is a member of the Trilateral Commission as well. Wells Fargo's other directors include: Wilson Riles, State Superintendent of Public Instruction and a PG&E director; Arjay Miller, ex-president of Ford Motor Co., director of Utah International and Trilateral commission member; the president of Rand corp.; the president of Hewlet-Packard; we could go on but for space and time...

While not as international as B of A, Wells Fargo has its share of dirty investments in places like South Africa: for example, they lost a pretty penny when Somoza was overthrown in Nicaragua. And they're well-known on most of California's college campuses for their service charges!

In 1803, long before Wells Fargo was even a jingle in its founders' pocket—let alone a member of the Hall of Shame—the governor of the state of Vermont recognized the likes of Wells Fargo for what they were—and still are—stating:

"Banks, by facilitating enterprises both hazardous and unjustifiable are the natural sources of all that class of vices which arise from the gambling system, and which cannot fail to act as sure and fatal, though slow, poisons to the republic in which they exist."

Kidder Peabody, 555 California

This little ol' investment bank (with more than its share of nuclear investments) 3,400 employees at least 400 of whom are vice-presidents. They sell stocks too, and have over a thousand sales people to do it. Not a giant, but a real power in the investment world.

First Chicago National Bank, 555 California

11,000 employees.

This nuclear investor (and Kerr McGee's bank) is another powerful regional bank. Their board of directors is studded with "old names" from the heyday of the robber barons (are those days really gone?) like Swift (meat), Ingersoll (equipment), and McCormick (farm machinery).

This bank has since gone bankrupt in one of the largest in US history.

Goldman Sachs, 555 California

Just another one of your blue chip New York investment banks: lots of money, lots of partners (over one hundred), and lots of nuclear investments. One of those partners used to be Secretary of the Treasury, but he's back to making money the banker's way (by having it to rent out) instead of the government way (by printing it). (Now one of the most powerful brokerages in the world).

Prudential Life Insurance, 555 California

The biggest insurance company in the U.S., Prudential owns over 5% of 200 companies including Chase Manhattan Bank and Citicorp. Prudential has major holdings in 18 of the top 36 nuclear corporations.

The "Pru" didn't start out so big. At first they mainly sold burial insurance to working people. Then they shifted to "industrial" life insurance. If a worker didn't pay for three years straight they cancelled his/ her policy and pocketed the money. Two thirds of the workers who took out Prudential policies were cancelled out before their investment was worth anything. So the rich grow richer.

Corporate headquarters are in Newark, New Jersey but Prudential is a "decentralized" company, so they have eight other skyscrapers (including the one in S.F.) for the regional companies. Like ail insurance companies. Prudential is rich in cash and investments. The Pru has $26 billion in corporations, $13 billion on mortgages, and $2 billion in real estate, making it the fifth biggest US corporation of its size in assets, only falling behind AT&T, Bank of America, Citicorp and Chase Manhattan. Prudential has stuck to investing and insuring, by and large. One exception is PruLease which leases nuclear-fuel cores to nuclear power plants. So remember, if you buy "a piece of the rock" it will be radioactive.

Paine, Webber Jackson & Curtis Blyth Eastman, 555 California

Blyth Eastman is an investment bank owned by the stockbroker Paine Webber—Someday you might say "thank you Paine Webber" too. But I doubt it. Paine Webber weighs in with 3,400 employees and over $895 million in sales. Blyth Eastman has 2,700 employees and an ex-VP as the new Asst. Secretary of the Interior. Paine was swallowed up after the removal of the Glass-Steagal Act by Switzerland's largest bank.

Morgan Stanley, 650 California

A some might presume from the name, this $5 billion investment bank is part of the Morgan interest group called by some the "most powerful investment banker in the world", Morgan Stanley has recently gotten "bullish" and they've launched a buying spree. Among the "bullchips" they are high on are many old favorites of the Hall of Shame such as GE Citicorp(se) and Union Pacific.

Homestake Mining, 650 California

Just a little mining company based in San Francisco Specializes in precious metals. . . like uranium. The company only grosses about a third of a billion a year and employs a mere 2,350 people, but they get around. President Harry Conger was just appointed to PG&E's Board of Directors. Homestake made the news in February, 1977 with a radioactive tailing spill at Ojai, New Mexico. They bank at Wells Fargo their accountant is Deloitte, Haskins & Sells.

Bank of America, 555 California

559 billion in assets 74,000 employees

By many measures Bank of America is the biggest bank in the world. This means power and it means that it would be a miracle if B of A wasn't a major nuclear investor. No miracle here; B of A is a top five shareholder in a number of gigantic nuclear corps, like Westinghouse and Union Carbide. They also work closely with PG&E which isn't surprising. It seems B of A has an interest in everything in Calif.

And not just California. B of A has caught public flack before, most recently for over $200 million loaned to the communist dictators of Poland. As an anonymous banker admitted: "Most bankers think authoritarian governments are good; they impose discipline." This probably accounts for B of A's heavy investments in South Africa and other repressive governments in Latin America and Asia.

It may be hard to believe, but Bank of America was once called the "People's Bank" in honor of their role in fighting Southern Pacific which had a stranglehold on California and that included other businesses. Now, the businesses collectively have a stranglehold on California which B of A no doubt thinks is a lot fairer.

There isn't enough room to list the numerous powerful interlocks in Bank of America. The bank's last president went to New York to take charge of the World Bank. Most people considered it a demotion. What can we say?

Bankers Trust of N.Y., 600 Montgomery

77,000 employees $3.7 billion in assets

"Welcome to the Wide World of Bankers Trust"

Bankers Trust has directors from DuPont's new oil company, Conoco, from IBM, and also serving on the Bankers Trust Board of Directors are the head of AT&T, Celanese Corp., Bristol-Meyers, Newmont Mining, and Mobil Oil. Sounds like a trustworthy group of rich white men, doesn't it? Price Waterhouse keeps account of their millions in profit.

EDS Nuclear, 220 Montgomery, #598

This is also a secretive company. Aren't listed with the SEC or Standard and Poors or even Dunn and Bradstreet. But they do show up on one list we checked: PG&E subcontractors for Diablo Canyon—$1,364,437 worth of "Design Review" in 79. Did a great job didn't they?

US Steel, 120 Montgomery

Sales: $12.5 billion Employees: 149,172

"We're involved"

Among the many steel products Big Steel puts out, they make the enormous steel plates that form the walls for nuclear reactors. Although steel accounts for 3/4 of their business, Big Steel is shifting its focus. A falling off of the steel market forced the shutdown of 160 steel mills in 1979 putting 13,000 people out of work. So Big Steel is relying more and more on its chemical plants, investments and uranium and coal reserves. They are large investors in nuclear banks; the US Steel pension fund, along with that of Bethlehem Steel, has $133 million invested in stock of Citibank, Chemical Bank, Continental Illinois, the Mellon Bank, Western Bank Corp., First Chicago, Wells Fargo, JP Morgan, Security Pacific and Ranier Bancorp. (These 10 banks have loaned $593 million to the Japanese steel industry; So, the retirement funds of US Steel workers is being invested to help drive the steel workers out of their jobs.) They are the new owners of Marathon oil.

Who owns this sprawling conglomerate now? Well, the employee pension plan has the largest portion with 13% of the stock: next is JP Morgan with 2.5% of the stock (although they haven't had direct control since JP jr. retired as chairman in 1932). DuPont owns 1.3%. They have interlocking directorates with JP Morgan (Walter T. Page is a retired chairman of the board of JP Morgan) and the Boeing Co. (T.A. Wilson, Chairman). Their accountants are Price Waterhouse, a big eight accounting firm—they also do the books for Standard Oil of California and Westinghouse. Also on the board at Big Steel is Cyrus Vance, secretary of state under Carter.

Equitable Life, 120 Montgomery

"Because there's nobody exactly like you."

Although smaller than Metropolitan in assets (35 billion) and employees (17,897), Equitable has a slight lead when it comes to major investments in the top 36 nuclear corporations—14 as compared to 11. The Equitable got its start when life insurance enjoyed increased popularity during the Civil War. The company founder, John Hyde, was one of many rich people who paid someone else to fight in his place. The $800 Hyde laid out to send another man to war he called "the best investment I ever made."

The corporate motto is "To rich and poor alike" but actually, as with all these corporations, it is the rich who reap the vast majority of the benefits.

Provident Life, 120 Montgomery

Just $1.6 billion in assets for this Pennsylvania insurance co., but it's well placed in such key stocks as GE, Kerr McGee, Union Carbide, DuPont, and the Southern California construction giant-Fluor.

Citibank/Citicorp, 44 Montgomery

The Corp. owns the bank. The bank owns a lot of nuclear corporations, with its $14 billion. Over 50,000 employees try to keep track of it. The Chairman of Citi/everywhere is also the head of the N.Y. Federal Reserve Bank and enjoys a permanent seat on the Federal Reserve Board. But Citi/omnipresent doesn't lack for friends; on its board are the heads of DuPont, Exxon, Halliburton, United Technologies (General Haig's old firm), Xerox, Standard Oil of California and the ex-chairman of AT&T. Executive Vice President Joseph Wright has gone to Washington to be Deputy Secretary of Commerce. Accountants: Peat Marwick.

Crocker Bank, 1 Montgomery

$3.4 billion gross 16,700 employees

16,700 employees, $3.4 billion gross earnings, and it's owned by a foreign bank. It's your typical big bank, directors from Bechtel, Standard Oil of Calif., Time Magazine, Del Monte, etc Share a director or two with PG&E. Right now it's the ubiquitous owner of Lev! Strauss—Mr. Walter Haas. Crocker lost a director recently—William French Smith, now Reagan's Attorney General.

SO WHO OWNS CROCKER? Midlands Bank, headquartered in Birmingham, England bought 51%. But who owns Midland? Standard Charted Bank has 19% of Midland and according to some, it controls Midland. But Midland has 16% of Standard so maybe the reverse is true. Standard Chartered Bank is another English bank. They have 800 offices in South Africa (2nd biggest bank there) and so have benefitted from aparthied significantly. Standard Bank also owns Union Bank. In 1965, Chase Manhattan bought into Standard heavily. So is Standard a Rockefeller corporation now? Probably only in spirit...Midlands has deposits of L. 9 billion. Standard has about the same. Chase has over $30 billion. And how much are you worth?

Note: In 1986 Midlands changed its name to the Hong Kong Shanghai Bank Co. (HSBC). Midlands, by the way, was originally constructed in the 1850's out of the remnants of the East India Trading Company). Also in 1986, Midlands was done stripping Crocker bank of its Asian assets and sold what was left of it to Wells Fargo bank.

Morgan Guaranty Trust, 400 Montgomery

This is a key corporation. With over $30 billion in assets, this is the flagship corporation for the Morgan interest group. Namesake Morgan got his start in business when he sold thousands of used rifles to the Union Armory in St. Louis during the Civil War claiming they were new. He never looked back. Morgan Trust is a major holder in numerous key nuclear corporations. George Shultz, ex-Sec, of the Treasury and now President of Bechtel sits on the Morgan Board, so does the Chairman of Conoco, the oil company the Duponts just bought, so does the chair of IBM, the Pres. of NY Life, the Chairman of MIT, and the Pres. of the University of Chicago. Morgan has direct interlocks to GE, ABC(2), Prudential Life, Metropolitan Life, Union Carbide, and U.S. Steel. Famed right-wing economist, Alan Greenspan, sits on the Morgan board as well as on Mobil's.

As befits their status, Morgan Trust has more senior vice-presidents than any other firm we've researched: more than 600. Their auditors are Deloitee, Haskins & Sells.

Dean Witter Reynolds Holding Corp., 45 Market St.

Fourth in capital ($274 million), second in salespeople (4,000) and third in offices (295), this stockbroker/investment bank does over $700 million in sales a year including large quantities of stock in nuclear corporations. Their slogan is, "You look like you just heard from Dean Witter!' That could mean almost anything. Dean Witter heard from President Reagan and he hired one of their attorneys, Roger Mehle, to be Asst. Secretary of the Treasury. (Witter is long gone)

Standard Oil of Ohio (SOHIO), 1000 Pine

Sales: $7.9 billion; Profits: $1.2 billion; Employees: 24,145

Sohio hasn't always been No. 9 among oil giants. When Jersey (Standard) Oil was forced to divest itself of 35 other companies in 1911, Sohio was left with a Cleveland refinery, a few stations, and no oil. In one year—1968—they gained-more crude than any other American oil company, accumulating assets of $9 billion. How? By selling 53% of themselves to, British Petroleum (BP), the owners of the biggest share of Alaska's North Slope, and by borrowing from 76 separate institutions. Sohio is now part of the intricate web of international oil. It's controlled by BP, which in turn is 45% owned by the British Government. Conceivably, BP—with 3 directors on Sohio's board—could step in and take over at will.

Sohio owns, besides 53% of the Prudhoe Bay/North Slope, 1/3 of the Alaska pipeline, another big moneymaker. But some of the profit came from gouging; that's what a federal judge indicated when he found Sohio and 7 other companies guilty of overcharging to the tune of $94 million. They can afford it; they just snapped up Kennecott chairman Thomas Barrow. Sohio is a perfect example of money dictating energy choices; they need huge projects like coal gasification ($1 billion), shale-oil ($2-4 billion), nuclear fusion and synfuels to absorb their excess capital.

To help us decide that Sohio is the wave of the energy future, they published 100,000 copies of Milton Friedman pamphlets on free enterprise and Sohio. Apparently, people in New Jersey weren't convinced; they forced Sohio to back off a proposed uranium mining project.

Note: It has long been a part of British Petroleum.

Kerr-McGee, 100 Bush St.

Sales: $3.48 billion; Bank: First Chicago; 11,286 employees; 4,350 in chemical subsidiaries; Number One in uranium production.

Anderson Kerr, a small Oklahoma-based oil company, got its first big break in 1935 when Robert S. Kerr fought a city ordinance requiring voter approval for drilling oil within the City limits-He did so at the behest of Phillips Petroleum, which held most of the oil leases in the area. They won and Anderson-Kerr took a small percentage of each Phillips oil well that "came in". Two years later, Anderson retired and Kerr hired Dean S. McGee, a Phillips petroleum geologist (some say the best in the country) as a 12.6% partner, while Kerr turned his attention to politics, becoming governor of Oklahoma in 1942.

While Dean was building Kerr McGee into an energy conglomerate/'Smilin' Bob" Kerr won the senatorial election and began spreading money around Capitol Hill in the form of "loans" and "campaign contributions", anywhere he could buy votes for gas, oil and banking bills he pushed. Smilin' Bob's influence-peddling paid off and in 1949, Kerr McGee became the 1st US oil company to sign contracts for oil drilling in the Saudi Arabia-Kuwait Neutral Zone in the Persian Gulf and in Mexico near the Yucatan Peninsula. By 1950, Kerr McGee had completed the oil loop: prospecting, drilling, refining and selling.

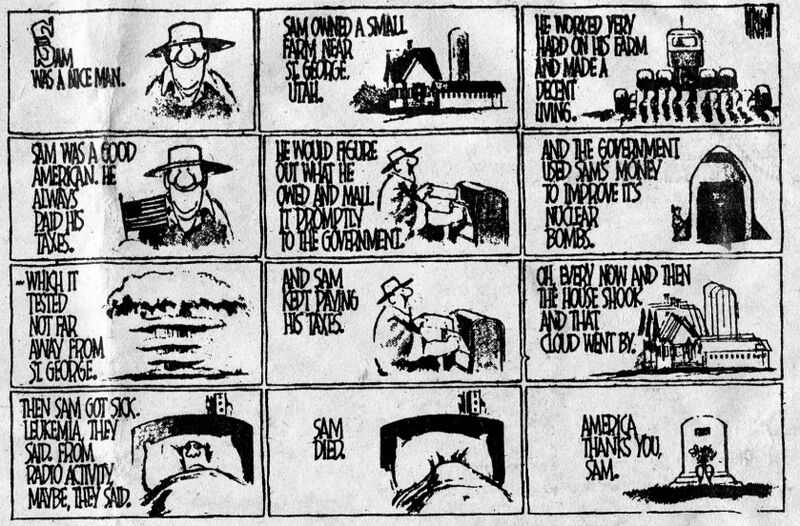

Kerr McGee first became involved in uranium mining in the mid-1940's when they leased 1,275,180 acres on the Colorado plateau near the borders of Colorado, Utah, Arizona and New Mexico, in the middle of a Navajo reservation. By the mid 50's, Kerr McGee was mining and milling uranium and the AEC was its only customer. Kerr arranged this through Admiral Lewis Strauss, chairman of the AEC, for whose confirmation as chairman Kerr had voted.

Kerr built strong political ties through kickbacks and back-scratching. Smaller companies began to complain that they were getting squeezed out. When Smiiin' Bob died suddenly of a heart attack in 1963, there was $50,000 in a safe deposit box in the National Savings and Trust Co., part of a $400,000 bribe to kill an initiative introduced by Pres. Kennedy that would have taxed savings and loan associations the same as banks. Bobby Baker, his middle man in the deal went to jail for influence peddling two months later. In 1970, Kerr McGee completed the uranium loop with the opening of their Cimmarron, Oklahoma plant (which manufactured Plutonium-Uranium fuel rods). That Cimmarron plant is where Karen Silkwood worked and her story is one of the most well-known stories of nuclear terror. But few know of Kerr-McGee's history of disregard for the health and safety Of its workers.

When Kerr McGee began its mining and milling operations in the Colorado plateau they put hundreds of unemployed workers to work. In Red Rock, Arizona they didn't tell miners anything about radiation and its hazards and they didn't install any ventilation. Margarito Martinez testified at the Bureau of Mines hearings that information about radiation was either withheld or hard to obtain from the company. The level of radiation in those mines was often 100 times higher than danger levels are allowed today. When federal inspectors did come to the mines, they were often diverted to areas with good ventilation and lower radiation levels. By the time federal regulations were imposed in 1968, most of the mesa mines were closed. Many of the workers employed at the Kerr McGee mines and mills are now dead or dying of cancer and other radiation-related diseases. Kerr McGee refuses to pay compensation to the victims or surviving families. Twenty-six out of 100 Navajo workers employed at the Kerr McGee mine in Red Rock have died of cancer. More are still dying.

Howard Kohn, author of Who Killed Karen Silkwood? speculates that Karen died because she discovered that Kerr McGee had sold to foreign governments 40 pounds of plutonium reported missing from the plant. Only Kerr McGee officials know exactly why Karen Silkwood was killed. We do know that on the night of her death, Karen was on her way to a meeting with reporters and that she had in her possession a folder containing much damaging evidence of Kerr McGee's illegal practices. Although it was seen at the scene of her death by a highway patrolman, the folder disappeared and has never been found. Shortly after that, the plant was declared unsafe and shut down. The missing plutonium has never been accounted for. In the hearings that followed, a former Kerr McGee supervisor at the same plant testified that when he was employed at another Kerr McGee plant, he was twice asked to divert plutonium from government stockpiles to Kerr McGee stockpiles.

So there you have it: Kerr McGee, a giant in the energy field, number one in uranium, and up to their necks in graft, extortion and murder.

U.S. Department of Energy (DOE), 333 Market St. (moved to Oakland)

- "History has destined this American nation to be a super power—indeed the single great super power among the free nations."

- —James Schlesinger while Sec. of DOE

SIZE: A budget of over 11 billion dollars. More than a third of it slated for nuclear arms development.

WHO IT CONTROLS: The so-called "multi-program" labs: Livermore, Los Alamos, and Sandia weapons laboratories and the Argonne, Brookhave and Oak Ridge national laboratories, which together employ 60,000 people.

FRIENDS IN HIGH PLACE: Senators whose committees would be downgraded if DOE was reduced to sub-cabinet level and the corporations like Union Carbide, GE, etc. who have DOE contracts.

SCANDALS: DOE was created in 1977, presumably to take over regulation of the oil industry and "solve the energy crisis." However, the first page of DOE's itemized budget reads "Atomic Energy Defense Activites" ($3.7 billion) and includes both weapons activities and security investigations. The two secretaries prior to oral surgeon Edwards both came to DOE via the Pentagon; more DOE money is invested in weaponry than in agency-sponsored energy production, demonstration and distribution combined. The "multi-purpose labs", home of most of this country's energy research and development activities, also reflects a weapons bias: 45% of the employees conduct weapons research having nothing to do with "forestalling the energy crunch".

DOE's energy work isn't any improvement over their weapons work. Fusion and Synfuels get the bulk of the money with a little left over for attempts to make solar and other alternative energies centralized. As in the case of nuclear power, the policy is for DOE to do what isn't profitable, leaving all the lucrative activities to the private firms. ..

Now DOE says there is a massive shortage of weapons-grade plutonium 239, needed to produce 17,000 new warheads slated for deployment during the next decade. This, together with the depressed market for power reactor construction has spurred Energy Secretary Edwards to push an industry plan for a $50 billion bail-out for the "ailing" industry. This plan calls for the federal government to buy all unfinished power reactors and complete them — taking control of the spent fuel rods for reprocessing into weapons-grade PU239 using the new "laser-isotope separation" technology developed at DOE's Livermore Lab. This $50 billion boondoggle amounts to overt militarization of commercial nuclear energy facilities for the express purpose of arming the new generation of first strike weapons.

Since hundreds of pounds of uranium and plutonium have been "lost" from the DOE labs it is no surprise that the DOE is not excited about public scrutiny. The agency denies 60% of the Freedom of Information Act queries it gets; of these, almost half the denials are successfully reversed.

At the Union Carbide operated DOE Paducah enrichment plant, workers laid their radiation badges on a smoking chunk of uranium for eight hours and turned them in. The badges went to the Union Carbide-operated DOE Oak Ridge National Lab. No excess radiation was reported. Referring to similar problems at the Goodyear Atomic/DOE enrichment plant near Portsmouth Ohio, OCAW union president Dennis Bloomfield said: "Would you leave a drunk to guard a bar? Would you leave another drunk to guard that drunk that is guarding the bar? The same parallel can be drawn with Goodyear and DOE."

QUESTIONS FOR THE HALL OF SHAME: Where does the lost uranium and plutonium go? Why do even Republicans consider DOE a scandal? Why is a dentist in charge of making the nuclear weapons for the United States?

Pacific Coast Stock Exchange, Pine & Sansome

This is the third biggest exchange in the U.S. Almost all the major nuclear corporations have their stocks traded on this exchange as well as one of the two in New York (New York Stock Exchange and American Stock Exchange). Regional companies also have their stock traded on the exchange. Most of the big investment banks/brokerage houses have representatives on the exchange. The New York Stock Exchange was once totally disrupted when a few people threw money from the public galleries down on top of the working stockbrokers below. This exchange doesn't have a public gallery.

Pinkerton Corporation, 731 Market St.

One of PG&E's biggest contracts for Diablo is this corporation. Their specialty is security of course. Founded by the man who was responsible for Lincoln's safety, despite his record he went on to form a detective agency that specialized in serving the rich and powerful. Pinkertons murdered strikers and labor organizers in numerous confrontations over the last 100 years. Security is big business as we can see by looking at Pinkerton's 36,000 employees and a gross income of $285 million last year.

Connecticut General Insurance Corp., 595 Market

Connecticut General now owns Aetna, No. 1 in property insurance. Together they have $80 billion of insurance in force and almost $17 billion in assets. Among their assets—almost 1/2 million shares of PG&E. Among their other nuclear holdings is a big chunk of Standard Oil of Ohio.

Metropolitan Life, 425 Market St.

With only $9 billion in yearly sales, a mere $48 billion in assets, Met is only the second biggest U.S. insurance company. A major investor in 11 of the top 36 nuclear corporations, the MET is considered the last to try anything new. 9th in total assets among U.S. corporations, the Met's board of directors includes the top officers of Union Carbide, Con Ed, Crocker National Bank, the Royal Bank of Canada, as well as former defense secretary Melvin Laird.

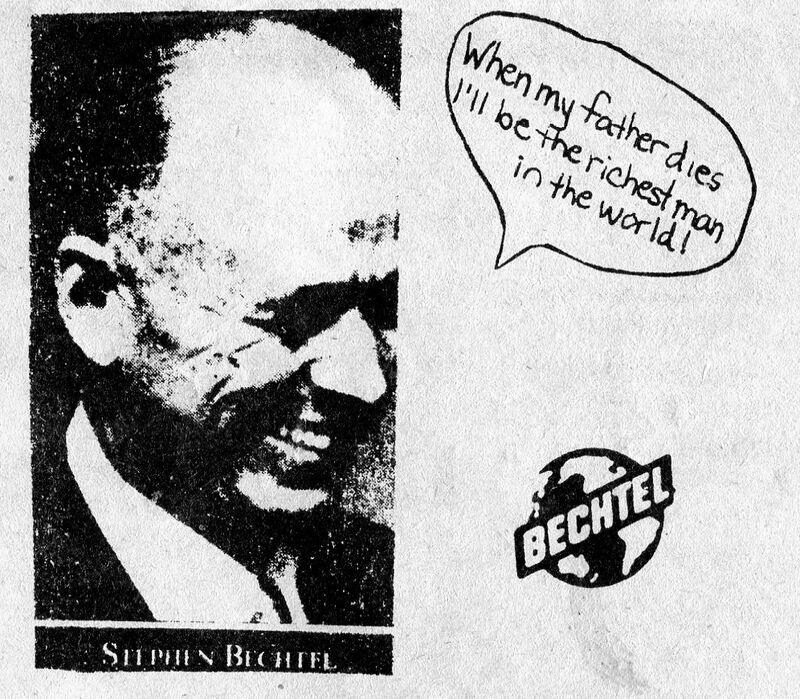

Bechtel, 50 Beale Street

"If Bechtel manufactured musical instruments or beer, its complete lack of public accountability would not be so alarming. But a company which has designed or built almost 1/2 of our nuclear power plants...must be able to stand the light of day..."

- —Mark Dowie, Mother Jones

When Bechtel's name first came up in nominations for the Nuclear Hall of Shame, there was contention. Nobody seemed sure whether Bechtel—the engineering and construction concern which has had a hand in ever half of America's nuclear power plants-qualified as a multinational corporation or as a sovereign state. Two factors clinched the decision. First, no one knew how to determine the boundaries of Bechtel, and a state must certainly have boundaries. Second, Stephen Bechtel, Sr., former President and now Senior Director and Ambassador of Bechtel, was elected in 1976 to the Fortune Hall of Fame for Business Leadership; the editors of Fortune are more expert than we at distinguishing what is business and what is government.

Again, to quote Dowie, "few unnatural forces have altered the face of this planet more than Bechtel Corporation." Today, Bechtel is involved in the construction of a major industrial city in Jubail, Saudi Arabia: three oil refineries; four petrochemical plants; a steel mill; a deep water port; hotels, hospitals, an international airport; the world's largest desalinization complex. As well as having erected more fission reactors than any other company, Bechtel has always been in the vanguard of nuclear technology. In 1951, in Arco, Illinois, Bechtel built the world's first nuclear power plant. In 1959, in Dresden, Illinois, they completed America's first commercial nuclear plant. In San Onofre, Bechtel installed a 420 ton reactor vessel backwards. Such mishaps have not wilted their confidence.

Bechtel's power plant at Tampur, India—co-built with G.E. on a U.S. Agency for International Development (AID) loan of $80 million—leaked so much material that 1300 workers had to be removed because, in one year, they had absorbed their maximum radioactive tolerance levels. According to an Atomic Energy Commission report on this disaster, at least two of these workers have since died of cancer. But the AEC is conducting no follow-up studies.

Bechtel has constantly proven its ability to influence every sector of the technological world. It contributes heavily to conservative political candidates and to legislative battles, such as the $390,000 in direct and indirect contributions (second only to PG&E) laid out to oppose a 1976 Caifornia proposition that would have imposed stricter safeguards on nuclear power plants. It also cultivates good relations with members of the US government, often by employing them—a tradition initiated when John McCone (president of Bechtel-McCone, a major defense contractor during WW II) went on from Bechtel to become chairman of the AEC and director of the CIA. Connections with the CIA have meant profits for Bechtel. More recent talent swaps include:

- —George Schultz, a former Secretary of the Treasury and of Labor who is now president of Bechtel;

- —Caspar Weinberger, a former Secretary of Health, Education and Welfare who later went to work as general counsel for Bechtei and who is now Reagan's Secretary of Defense;

- —Parker T. Hart, a former ambassador to a number of Middle Eastern countries who is now a consultant to the company;

- —Richard Helms, a former director of the CIA who also has been retained as a consultant.

SCANDALS: Bechtel has been embarrassed by some of its tactics being exposed in the courtroom. In 1972, a woman employee filed a class action suit against Bechtel for sex discrimination in job assignments and promotion; Bechtel settled out of court by paying $1.4 million in damages to past and current employees. Four hundred black employees then filed a race discrimination suit. Bechtel was sued again in 1978 by the directors of Consumer Power in Michigan when the Palisades nuke they had built broke down shortly after it opened. Bechtel was also charged in 1976 with refusing to deal with American subcontractors who were on the Arab blacklist of firms that do business with Israel.

Questions you'll love to learn the answers to on the Hall of Shame Tour:

What is Bechtel doing in China? Or in Alaska for that matter?

Pacific Gas & Electric, 77 Beale Street

"We Keep a smile on Mother Nature's Face."

- —A PG&E advertisement

"PG&E has transformed a once wild and free-flowing stream into a series of stagnant, polluted, overheated, silting, artificial reservoirs and scarred the length or the river."

- —Pit River Indian Tribe Public Statement

SIZE: Over 26,000 employees; 4,600,000 angry customers, and millions of miles of pipes, tubes, wires, and press releases. The largest and (formerly) the most profitable electrical utility in the world.

PRODUCTS: PG&E buys cheap energy from the government or steals it from nature, and then transmits it and sells it for vast profits to millions of people who have not other practical energy choices. PG&E also builds (but usually can't run) nuclear power plants. i

THE BIG BOYS IN CHARGE: PG&E might be your local utility but they're part of the big-time. PG&E is especially intimate with two important nuclear banks—Wells Fargo and the Bank of California. Chairmen and directors of both these banks sit on PG&E's board, and PG&E Shell Oil, Del Monte, Safeway, American Express, Crocker Bank, and United California Bank. Wilson Riles, Supt. of Public Instruction for the State of California and a University of California Regent is also on PG&E's Board of Directors. NY and CA banks hold PG&E's mortgages and also control most of the outstanding stocks and bonds. Another big holder is the State of California through its University and several employee retirement funds.

SCANDALS: Even before San Francisco Gas and Electric changed its name to Pacific Gas & Electric, it had been embroiled in scandals. This is only natural since it occupies an exposed (and profitable) position half-way between "private business" and "public interest." The nuclear scandals—from the shoddy Humboldt Bay Plant to their famous Diablo facility right on top of an earthquake fault—are too numerous to mention. The hidden scandal Behind all this nuclear foolishness is that the billions dumped into Diablo and Humboldt and the millions spent since 1951 on nuclear research contribute nothing today to PG&E's power production. And PG&E has plans to throw more money down the nuclear rathole including $10 million pledged to the Clinch River Breeder Project and substantial sums for fusion research. And people wonder why the rates are going up.

PG&E may seem especially famous now; with PCB contaminations and cover-ups, Diablo, the Sierra Hydro disaster, the gigantic rate increases, etc., but they were always fin the public eye. For example, the Hetch-Hetchy scandal is over 80 years old and its history includes ecological despoliation, bribery by PG&E officials, ignoring Supreme Court rulings, and blocking the municipalization of PG&E by the City of S.F. These activities have enabled more than 80 years of continuous profitability and it's not over yet.

Some questions that will be answered during the Hall of Shame Tour:

Why did PG&E have the Bay Guardian excluded from the S.F. Press Club?

Who did PG&E hire to break into the home of a 90 year-old activist/grandmother whom PG&E called "a thorn in our side from the beginning"?

What is the connection between the many incidents of PCB contamination and the despoliation of the lands of the Pit River Indians?

ACCOUNTANTS

As one of America's Big Eight accounting firms, Deloitte, Haskins & Sells' place in the Hall of Shame is assured. As documented in the government report ("The Accounting Establishment", the Big Eight readily identify with the interests of their corporate clients (PG&E's accountant is Deloitte, Haskins & Sells) such as:

- - corporate taxation

- - fuel adjustment clauses

- - higher oil and gas prices

- - faster tax write-offs

- - charging utility customers for "phantom" taxes which are never paid

- - allowance of questionable "costs" for private contractors

- - opposition to uniform accounting methods;

- - opposition to stronger federal regulation of reporting by corporations Encouraging isn't it?

But the Big Eight (the others are Ernst & Ernst, Arthur Young, Arthur Andersen, Coopers & Lybrand, and HallofShamers ToucheRoss PriceWaterhouse and Peat Marvick & Mitchell) do take social responsibility very seriously. Fortune magazine reports: Accountants have traditionally been big joiners... but in the past, the initiative always remained with the individual. Today PD ("practice development") activities are closely coordinated—at some firms on a national basis.

At Peat Marwick, for instance, the article continues: every quarter each member of the "management group" is asked to make, in writing, a specific commitment to cultivation of contacts. At the end of each period he must submit a written report detailing how successful he has been in meeting his goals. All the reports are reviewed at the local level and sent on to national headquarters in New York.

Arthur Andersen encourages partners to join country clubs and requires them to contribute 4% of their cash earnings to non-religious charitable organizations. The individual decides where half the 4% goes; national and local offices distribute the rest. Peat Marwick also requires partners to contribute 4% to charity. Fortune reports that average compensation for Peat Marwick's 1,471 partners in 1977 came to $98,500. Price Waterhouse's 418 US partners averaged $144,000.

RACISM, SEXISM, EL SALVADOR, POLAND ...

"It's all connected—might just seem a radical cliche but it's not when you think of the real people who work, buy and die in intimate association with these companies.

Sexism can be just a word or it can be two GE managers raping their secretary in Lynn, Mass, last year. GE's coverup led to a wildcat strike by over 100 of her co-workers (the majority men) that forced the suspension (and later transfer) of the manager-rapists.

Racism might be a concept or it might be what led to Merrill Lynch and Co. being so flagrant in their discriminatory practices that they got nailed with 2 equal employment suits in 1976 that led to $1.2 million in fines and $1.3 million in affirmative action.

"Oppressing the third world" is just an accusation but in the Huey gunships that the U.S. sent to El Salvador is GE's XM machine gun that throws thousands of rounds a minute at peasants and rebels alike. Poland may be two continents away but the Bank of America has hundreds of millions of dollars invested in the present regime.

It all seems so unreal. Right now, as you read this, submarines with more destructive power than World War II glide a mile beneath the surface waiting for an accident or insane command to unleash their missiles. And what are you waiting for?

LAW FIRMS

The Hall of Shame tour includes Brobeck, Phelger and Harrison, legal counsel for Wells Fargo, among others. In 1978, Wells Fargo paid $2,331,194 in fees to Brobeck, Phleger and Harrison—possibly economizing on postage by hand delivering the checks to Mr. Phleger when he's over at 464 California for a Wells Fargo board of directors meeting. Former Secretary of State William Rogers facilitates the flow between his firm, Rogers & Wells, and client Merrill Lynch in a similar fashion. Business Week reported that Rogers received the largest total payments by a corporation to a single lawyers director in 1978.

Another Hall of Shame great, Pillsbury, Madison and Sutro, are the biggest law firm on the west coast and the eighth biggest one in the country. They are the in-house firm for Standard Oil (a major nuclear investor) and can be found busily slave-driving their clerical staff at the Standard Oil Building. They also used to be the in-house counsel for Utah International, one of the most notorious land rapists... digging away for uranium and coal along the Grants Mineral Belt in the Four Corners region. Since the merger with GE in 1976, Utah only calls on Pills-bury, Madison and Sutro when there's special work to be done. DuPont also avails itself of their services for their west coast activities.

Most of the giant corporations have their own lawyers; firms such as Pillsbury generally lend a hand to the up and coming young titans. With their stable of 250 attorneys, Pillsbury can offer an extremely wide variety of highly specialized areas of the law, to insure that they can drown their opponents in a sea of paper and ink. The Lawyers Almanac lists their three favorite areas of practice as energy, environment, and corporate antitrust defense.

But to hold a lawyer responsible for the improper practices of a client corporation is patently unfair, as SEC member Roberta S. Karmel, former partner in (whaddya know!) Rogers & Wells said: "An attorney can't represent a client if he's worried about his own liability." Or as Abe Krash, a corporate attorney in a Washington, D.C. law firm has said, "A lawyer does not have the right to impose his ethical and political beliefs and his notions of social responsibility on his clients." Hence, legal opinion is entirely distinct from personal opinion. A study of schizophrenia among corporate lawyers would undoubtedly uncover a sad situation—these men must b.e classic cases, having to be constantly on guard against the "personal" trespassing into the realm of the strictly business client-lawyer relationship.

And isn't it "guilt by association" to tar a lawyer with the views of his client? As Mark Green writes in "The Big Board Room Lawyers" (The Nation, April 23, 1977): "When the ACLU defends Nazis or Communists from unconstitutional infringements, it is wrong to perceive the lawyer as endorsing his clients' policies; rather, he or she is upholding constitutional safeguards due any citizen . . . Yet this contrasts with a corporate lawyer who, On a continuing basis, advises his client not merely on constitutional safeguards but also on policy matters... What if the client ignores its lawyer's counsel, or what if the lawyer advises not what ought to be done but what the client can get away with? It seems illogical to criticize, say, a corporate polluter, while at the same time forbearing to criticize the Washington lawyer whose perennial strategies may permit the pollution."

Therefore we applaud Hall of Shame legal giants Brobeck, Phleqer and Harrison, and their brother firms (notice the almost complete absence of female pronouns in the foregoing?) for continuing the struggle to simply "do their job", courageously disregarding dangerous attempts to pervert the sanctity of client-counsel confidentiality and to introduce the totally inappropriate element of individual conscience into matters strictly in the realm of business, society, government and life on earth!

unindicted co-conspirators: crystal, juana, snail, rabbit, gail, modoc melanie, bug, dan and tim paloma, shoshone, rick, james, ja-jason, and kabita. Special thanks to Matrix for everything!