Connected Treasure Island Developers Cultivated Profitable Deal

Historical Essay

by Alison Hawkes and Bernice Yeung

How the city handed over control of one of the city’s most scenic locales — despite audits, voter anger and rebellious bureaucrats

World famous view from Treasure Island's west shore, looking southwesterly in 2007.

Photo: Chris Carlsson

Art deco type denotes the original airport, now a museum, reflecting its view of downtown San Francisco.

Photo: Chris Carlsson

In the next six months, local officials and a consortium of private developers will begin to finalize legal papers for Treasure Island’s future as a high-density eco-city. Renderings of the gleaming towers, parks and gardens suggest harmony and community. Yet the promise of an urban Treasure Island, one of the most complex and risky redevelopments in San Francisco’s recent history, has for more than a decade been wrapped up in a process driven by power and influence. The mayor got near-total control. Political friends got plum jobs and contracts. Critics were exiled. City and state conflict-of-interest laws were waived. Independent inquiries and the will of voters were nakedly rebuffed.

Big projects naturally draw big money. Treasure Island, currently slated for $6 billion in residential and commercial development, was an unusually large prize. But companies with political and social ties to two mayors won the two major projects related to the redevelopment—with the master development drawing only one serious bid.

The winning bidder was a group that included Darius Anderson, an influential Democratic Party lobbyist and fundraiser for both outgoing Mayor Willie Brown and incoming Mayor Gavin Newsom.

One partner was the Miami-based homebuilder Lennar, then the second-largest in the nation, also now leading the concurrent $7 billion Hunters Point Shipyard redevelopment and the conversion of the former Mare Island Shipyard in Vallejo. Other companies, backed in part with public employee pension funds, have also joined the team now known as Treasure Island Community Development.

Still showing signs of its long use as naval base in 2007.

Photo: Chris Carlsson

Over the years, few have been outwardly critical of the contracting process. An exception was former city supervisor and mayoral antagonist Tony Hall. During his brief tenure as head of the Treasure Island Development Authority he raised allegations—not all borne out by facts—of missed deadlines, unpaid developer fees and a “sweetheart deal” in the making.

In 1998, San Francisco voters attempted to wrest power from Brown and install good-governance practices for Treasure Island. But supervisors never implemented many of the provisions in the ballot measure, which passed easily. Even today, some current and past city supervisors say they had to pick their battles, and Treasure Island has been a remote concern.

Bill Rutland is a lobbyist and a close friend of Brown who briefly worked on behalf of Anderson, the lobbyist, to win the first part of the Treasure Island redevelopment bid. He said that despite appearances, his team won the contract on merit.

“Anybody that has the size and capacity to do these types of billion-dollar deals is going to have relationships with the powers that be,” Rutland said. “But they have to show a track record and a financial capability for doing that.”

But Charles Marsteller, a former coordinator of San Francisco Common Cause, said no matter how dazzling the eco-city seems on paper, insider politics represents a giveaway to companies with unusual access to government decision-makers.

“The public thinks we’re going to build a city in the public’s interest,” he said. “I would say we’re building a city in the private sector’s interest—and whatever they want, we’re getting. Ultimately the residents have to live with the consequences long after the developer is gone.”

Consolidating power

From the start, Treasure Island was Brown’s pet project. In 1997, as the U.S. Navy began shuttering operations on the island, the former state Assembly speaker parlayed his influence over the Legislature to push a bill establishing a separate governing authority for Treasure Island.

The move provoked opposition. A Brown political rival, former state senator and retired judge Quentin Kopp, suspecting Brown would appoint loyalists, fought against the bill. “He could control them,” Kopp said. “The objective was always to get the development power in the hands of friends and political supporters.”

As expected, Brown won, and the articles of incorporation for the Treasure Island Development Authority listed the San Francisco mayor as the “sole incorporator.” Directors would be named by the mayor “in order to perfect the organization of the Authority.” City and state conflict of-interest laws forbidding city employees to hold dual offices were waived, making it possible for Brown to pack the authority’s board.

The authority’s governance structure is unusual for California. Although San Francisco’s mayor filled many appointments at city commissions, the agency overseeing Treasure Island is a state entity. At other converted military bases, power had been dispersed into the hands of many. March Air Force Base in Riverside County, for example, is governed by representatives from the county and three of its cities. In Monterey County, Fort Ord Army Base’s reuse authority consists of officials from the county and eight towns. McClellan and Castle Air Force bases in Sacramento and Merced counties are overseen by county boards of supervisors.

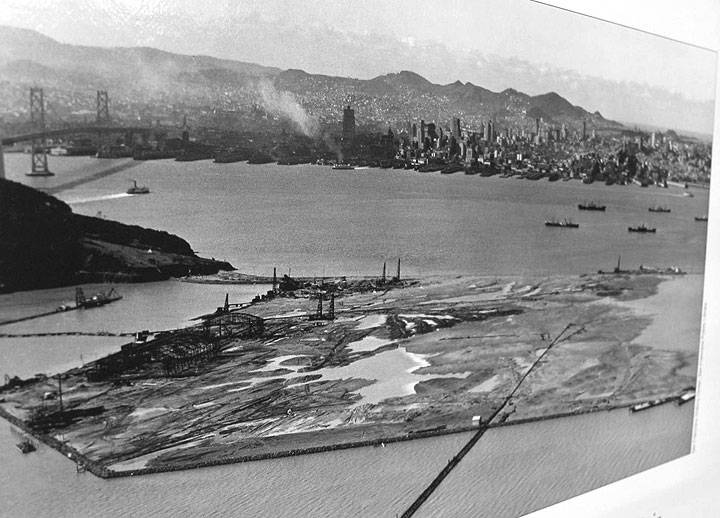

Treasure Island was a major government development effort from the beginning, seen here in the mid-1930s as it was emerging from the shallow baylands north of Yerba Buena Island with extensive dumping and diking. It's first use was for the 1939-40 Golden Gate International Exposition.

Photo: Treasure Island Museum

Former Planning Commissioner Gerald Green, one of Brown’s original five appointees to the Treasure Island authority board, defended the entity’s design and said knowledgeable people like him belonged on it.

“That was done not for mayoral control, but to have experienced people who could jumpstart the process,” said Green, who years later lost his planning job in an unrelated conflict-of interest scandal.

Also on the early board were the city’s directors of redevelopment and of the Port of San Francisco—both Brown campaign donors.

Among the authority’s staff were a number of “special assistants,” a cadre of city employees hired by the mayor without civil-service testing. A 2001 civil grand jury report noted that some were scrutinized in the press as patronage jobs. The report named several Treasure Island staffers, including former director Annemarie Conroy. London Breed, an unpaid intern in the mayor’s office who was promoted to development specialist and secretary to the board, now sits on the Redevelopment Commission. She defends Brown’s integrity: “He was really aggressive making sure the staff was by the book.”

But at least one critic said she was silenced. “I was pushed aside because I questioned too much,” said Lois Scott, a city planner who voiced concerns about the seismic safety of building high-rises on an artificial island. Scott said she was eventually demoted to code enforcement. (Green said the seismic issues were “thoroughly investigated.”)

By 1998, two political rivals saw an opening. Kopp and real estate millionaire Clint Reilly, who was gearing up for a mayoral run, launched Proposition K to substantially curb Brown’s power over the island. The ballot measure mandated that good-governance procedures should guide Treasure Island’s development. To blunt support for Proposition K, the Board of Supervisors preemptively adopted some of the changes, though fell short of stripping the mayor’s appointment power. Voters passed Prop. K, but it was never fully implemented. Former supervisor Michael Yaki said the voter-approved initiative was a declaration of policy, not a binding mandate, so the supervisors were under no obligation to follow it.

Yaki later had a change of heart. “I remember trying to go there one weekend and not being able to get to the base, and I thought this was very odd,” Yaki said. “I got more reports from other people.” Yaki began pushing supervisor appointments to the Treasure Island authority board. But his proposal never went anywhere.

Priming the pump

With the Treasure Island Development Authority in place, the city began priming the pump for redevelopment, starting with modernization of the Clipper Cove marina between Yerba Buena and Treasure islands.

Original airport terminal building, another of the early uses planned for Treasure Island. PanAm's famous Clippers would circle and land in the bay, and then taxi in to the adjacent Clipper Cove, below.

Photos: Chris Carlsson

Where PanAm Clippers once docked, now yachts have their way.

Among the first bidders to surface was Treasure Island Enterprises, backed by star Democratic fundraiser Anderson and his former billionaire boss, Los Angeles supermarket magnate Ron Burkle.

Their ties with Brown ran deep. Both had been part of Brown’s fundraising effort for his 1995 election campaign. Burkle was a former law client of Brown’s and donated to various Brown causes.

The Anderson-Burkle bid immediately provoked claims that the outcome was a fait acompli, and a civil grand jury looked into it. The resulting 1998 report said the Clipper Cove marina’s bidding process had never been made public “in an adequately informative way,” and called on the Treasure Island authority to use competitive, open bidding procedures.

The report went on to decry the lack of public oversight, and said the process had been “hampered by concern about the concentration of power, jurisdictional squabbling, political infighting.”

In spite of these concerns, three bids came in and none was easy to dismiss. The Port of San Francisco reviewed the proposals, and each had its strengths and weaknesses.

What might have killed the Anderson-Burkle proposal was the port’s findings that it would generate about $1 million less in revenue over a 16-year period than the two other applicants.

Nevertheless, the authority’s staff recommended Treasure Island Enterprises as the winner. A selection committee concurred and in February 1999 the Anderson-Burkle team secured the bid.

The plan had merit, but it didn’t hurt that Anderson and Burkle also had gotten to the right people. Anderson told the San Francisco Chronicle that he had paid lobbyist Bill Rutland, Brown’s friend, $30,000 to learn “what were the hot buttons of the general public.”

Brown and Anderson did not respond to requests for comment on the marina or subsequent deals. A Burkle spokesman would not speak on the record about Treasure Island. Rutland said in an interview that his job with Anderson was to shepherd the proposal through a slew of public agencies. But he did not recall talking to the mayor about it. “I wouldn’t have, because the decision was going to be in the hands of the authority,” he said.

Rutland added: “I couldn’t deny being Willie Brown’s friend. I really understood the process, and my ability was to help shape a proposal that meets the expectations and quirks that makes the city of San Francisco—and believe me, there are many.”

The other bidders were disappointed.

“We put out a prospect, submitted plans and financial studies,” said Terry Cowhey, who had partnered with one of the three marina bidders, Modern Continental. “It was a couple of volumes, phone books of stuff, we submitted. And it was all an inside fix. It was all based on who was Willie Brown’s buddy, and it had nothing to do with the technical qualities.”

The marina project was a toehold onto Treasure Island. When the city was ready to open bids for the larger redevelopment, Anderson was back at the table, this time with one of the largest homebuilders in the country, Lennar.

Would-be bidders drop out

To develop the rest of the island, the Treasure Island authority issued a public call for a master developer in October 2000. The brochure was sent out to 500 companies, and it boasted that the project was a “once-in-a-lifetime opportunity” to redevelop the “jewel of the San Francisco Bay.”

A few months later, the agency hosted a prebid conference and about 150 parties turned up. But by the February 2001 deadline, only two bids had come in.

One came from Navillus Associates, a group of investors that included an international financing expert and local actor Peter Coyote. The second bid came from a consortium called Treasure Island Community Development, which featured a familiar name from the marina development: Darius Anderson. Homebuilder Lennar was also part of the team.

By most accounts, the Navillus proposal for a “Magic City” was lackluster. Treasure Island Community Development submitted a document championing the team’s experience “developing large projects on challenging sites” and highlighting its strong financial footing.

The Treasure Island authority brought in a team of consultants—including Dean Macris, a former city planning director and Willie Brown loyalist—to judge the proposals. They dismissed Navillus for lacking relevant experience, financing and community ties.

But the Anderson-Lennar team met all the requirements. The consultants noted, in particular, that Lennar “has the financial capability to undertake this project without the financial participation of the other members” of Treasure Island Community Development.

The consultants said Lennar’s experience with Bayview-Hunters Point and the Mare Island base conversion in Vallejo, as well as Burkle and Anderson’s experience with the marina, illustrated the requisite “sensitivity to the built urban environment.”

Some Treasure Island authority staff voiced concern about the lack of competitive selection. But then-board member Gerald Green said the paucity of bidders simply reflected that “there are a lot of unknowns about what would be involved” with such a large and complex development.

Still, the agency agreed to hire yet another outside consultant to evaluate how to “improve the prospects for increased competition,” according to city records. It charged Bay Area Economics, a Berkeley-based real estate consulting firm, with anonymously interviewing five developers who had attended the pre-bid meeting but declined to submit a bid.

The firm reported that seismic issues were “10 times more important than any other concern.”

Developers also had “doubts about the financial feasibility of the project” and concerns that the cost of seismic improvements in an earthquake zone would “necessitate a level of density on the island that would be ‘unethical.’”

The report also noted that potential developers were concerned about “the political climate in San Francisco.”

The Treasure Island authority’s board discussed these findings at a September 2001 meeting and considered ways to improve the competitive process. For example, the report said, the city could explain how it would assist with the redevelopment, and it could “make a selection based solely on qualifications.”

If adjustments were made, two developers said they would feel “very positive” about submitting a bid.

Instead of reopening the bidding process, Treasure Island authority staffer Stephen Proud recommended allowing Treasure Island Community. Developers alone to submit a more detailed proposal because the staff did not think the agency would receive an “outpouring of new proposals.” (Proud later left the authority to oversee Lennar’s Bay Area projects, including Treasure Island.)

Development authority board member Marcia Rosen, then also the director of the city’s redevelopment agency, told the group that she supported Proud’s recommendation because it was “in the public interest to move forward expeditiously.”

Not everyone agreed. Six days later, the Treasure Island Community Advisory Board — a citizen committee charged with providing input to the development process — was briefed on the Bay Area Economics report. Some members expressed concern about moving forward with only one option.

“Rushing this project only places it in the hands of a small group of people who have no competition,” one member said. Former Supervisor Aaron Peskin said the scenario was not ideal from a public-interest perspective: “There were only two bidders, and one was completely out to lunch. So there was only one legitimate bidder, which became a problem because we were negotiating against ourselves, rather than negotiating with two parties.”

But the course appeared to be set. In April 2002, the Treasure Island authority board unanimously voted against reopening the bid, and it gave Treasure Island Community Development the exclusive opportunity to submit a request for proposals.

A few months later, Anderson’s team drafted a plan for a “model of 21st Century living,” which included housing on the most seismically unstable portions of the island. In January 2003, after listening to public comment, the developers came back with a revised plan that pulled housing away from the shoreline and included new parks.

The Citizen’s Advisory Board still had concerns. “It was not environmentally defendable,” said Kathrin Moore, an architect who sits on the board. “It was suburban in nature and density.

It was car-dependent and unresponsive to the physical setting of Treasure Island.”

In April 2003, the Treasure Island authority voted unanimously to approve the deal.

Enter Newsom

With the November 2003 mayoral election approaching, Anderson put his money on Gavin Newsom, whose $4 million campaign war chest received a lift from associates of his Treasure Island development team.

Though small, recorded campaign donations document a network of political bonds. Anderson’s Kenwood Investments, a partner in the Treasure Island deal, gave $250, while colleagues at Anderson’s lobbying firm Platinum Advisors—including Jay Wallace, who is actively involved in the development—collectively handed Newsom a total of $4,500.

Two of the principals of Wilson Meany Sullivan, the private real estate firm that was added to the development partnership in 2005, supported Newsom’s mayoral campaign and a political action committee that supported him. There were additional ties. Lennar employee Laurence Pelosi, the nephew of House Speaker Nancy Pelosi, served as Newsom’s campaign treasurer from 2002 to 2007. Chris Gruwell, Newsom’s campaign finance manager, also appeared to have an in with Anderson. After Newsom narrowly won the election, Gruwell went to work for Platinum Advisors.

A few months later, Anderson paid Newsom another favor, hosting a luncheon at Platinum’s Sacramento office to help Newsom retire $400,000 in campaign debt.

The event caused a flap because San Francisco law prohibits government decision-makers from accepting contributions from anyone vying for a city contract. But Newsom’s attorney was dismissive of the conflict-of-interest allegations, telling newspapers that the local statute didn’t apply to the Treasure Island authority because it was a state entity. (Newsom’s office did not return phone calls for comment.)

By the late summer of his first term, Newsom shuffled staff around. He created a new agency, the Mayor’s Office of Base Reuse and Development, and appointed assistant city attorney Michael Cohen as its director. Cohen had been involved with the Bayview-Hunters Point Shipyard development, and the negotiations over Treasure Island.

In what has since been dubbed the “triple play,” Newsom also reassigned the existing Treasure Island authority’s executive director, and persuaded Tony Hall, his conservative political rival on the Board of Supervisors, to take the job. Newsom then appointed mayoral aide Sean Elsbernd to Hall’s supervisor seat, providing Newsom with a fourth ally on the board.

Hall said in an interview that Newsom asked him to take the job several times, and he finally agreed because he considered himself a development expert. Hall was indeed a player in the city development game, and he counted Anderson among his political donors and fundraisers (Hall returned the $500 Anderson gave him in 2003).

Newsom’s decision to install Hall at Treasure Island turned out to be a gross political error, but it gave a brief window into the internecine politics of San Francisco development. Unlike his predecessor, Hall stirred the pot from the beginning. A few months into the job, Hall got into a public tiff with Newsom supporter and San Francisco Film Commissioner Stephanie Pleet Coyote—wife of the actor whose development plan was rejected—over the filming of the movie “Rent” on the island.

A few months later, The New York Times wrote about the redevelopment of former military bases. It included an inflammatory Hall comment that the Navy—which took over the island from the city during World War II—was delaying development by “holding us hostage on our own lands.”

Treasure Island became the eye of the political storm. When the Navy sent a letter demanding $1.3 million in unpaid maintenance fees, Treasure Island authority board member Matthew Franklin told local newspapers that Hall had invited the wrath of the Navy through his comments. (Documents show that the military had been demanding the payments since 1998.)

By the fall, Hall was openly clashing with board members. The developer’s contract was about to expire, and Michael Cohen of the Mayor’s Office of Base Reuse pushed for an extension. Cohen assured the authority’s board that these kinds of arrangements are “common on a large-scale development such as this,” even though a number of deadlines had been missed.

But Hall was convinced that this was another attempt to solidify a “sweetheart deal” for the mayor’s fundraisers.

“This is the most corrupt deal ever in the history of the city,” Hall said in an interview. (Darius Anderson did not return calls for comment, and Jay Wallace of Kenwood Investments declined to speak on the record.)

The board ignored Hall and approved the extension unanimously.

To add poison to the water, just days before that vote, an anonymous whistle-blower—Hall said he was convinced it was one of his foes from the Treasure Island authority board or staff—had sent a letter to the city controller’s office alleging that Hall had removed funds from the city’s control by opening separate bank accounts for Treasure Island rental deposits. Hall said he had set up new accounts because he was concerned that the city was improperly placing them into the city’s general fund. The story of supposed financial malfeasance was all over the news.

A week later, the Board of Supervisors held a hearing to sort out the “leadership crisis” at the Treasure Island Development Authority, according to city records.

“The mayor appoints all commissioners—for heaven’s sake, department heads who are clearly his votes,” said John Elberling, then-chief financial officer for the board, “and the other three of us are citizens who serve at his pleasure. ... It’s the mayor’s call.”

The hearing revealed the extent of the dysfunction at Treasure Island, highlighted by the controversial bank accounts. Despite well-publicized allegations to the contrary, Elberling said “the funds are functionally under the control of the treasurer’s office” and insisted that he did “not see an issue there.”

Then-Deputy Controller Monique Zmuda said that while her office was advising the board to take responsibility for the new accounts, it was not illegal or inappropriate. Furthermore, at the hearing, the supervisors learned that Treasure Island Community Development had failed to pay $1.8 million in developer fees to the Treasure Island Development Authority because the authority had never exercised the right.

“I said, ‘Where is the money?’” Peskin recalled. “The developer made representations that they would pay them, but they had not. They did pay once I raised the issue, and they paid retroactively.” At the following Treasure Island Development Authority board meeting, Supervisor Chris Daly, an ex-officio member of the board, called the lack of payments an “unbelievable corporate giveaway.” But the issue did not get much notice in the local papers, which focused instead on the political theater produced by the Newsom-Hall rivalry.

Then Hall appeared on ABC News, claiming that Treasure Island is “an inside deal—it’s structured to reward the mayor’s biggest donors or a group of his largest donors.” Newsom responded in the report that the allegation was “laughable.”

Anderson then went on the offensive, and told the Chronicle that Hall had asked him to grant a $420,000 Treasure Island lobbying contract to one of Hall’s business associates. Hall denied the claims and retorted that Anderson was “full of crap.”

Three days after Anderson’s allegations, Hall was fired. As outlined in his contract, Hall was given 30 days’ pay and a $254,500 golden parachute. The next day, the Ethics Commission informed the ex-supervisor that he was being investigated for using 2004 campaign funds to pay off a personal loan. Hall was fined $6,000, which he is contesting.

With Hall out of the picture, the storms over the island seemed to have passed. In September 2006, Newsom appointed Mirian Saez as the director of island operations. Previously she was the head of real estate at the Port of San Francisco. Her spouse is Julian Potter, a high-level Newsom staffer.

When additional seats on the authority board have opened up, Newsom has appointed heads of the Planning Department, the Mayor’s Office of Housing and staffers from the Mayor’s Office of Economic and Workforce Development. One appointee was listed by Lennar as a reference in a development submission to the city.

Private firms, public investment

Times have changed since the redevelopment of Treasure Island was first conceived more than a decade ago. While environmental and transportation issues have always been part of the puzzle, financing the project in the current economic climate has become another hurdle for developers.

Given the circumstances, responsibility for funding the project will fall to the few entities with the appetite for investing substantial capital in risky real estate development deals: big developers, wealthy private investors and public pension funds such as California Public Employees’ Retirement System, known as CalPERS, the largest in the country.

Treasure Island Community Developers appears to have tailored its financing strategy accordingly. One of its partners, Stockbridge Capital, handles CalPERS real estate investments. Jack Sylvan, the redevelopment director for the Treasure Island project, recently confirmed that CalPERS has placed funds with the Treasure Island development. As of 2009, the pension fund had about $62 million invested in Stockbridge projects, not always with favorable returns. Earlier this year, it was reported that CalPERS pulled out of a Stockbridge-managed deal that included Wilson Meany Sullivan, and lost $91 million in the process.

So while San Francisco residents may not have to assume financial risk related to the rebuilding of Treasure Island, California’s public employees will be exposed.

When it comes to access to public pension funds, it may have helped that Treasure Island Community Developers has Darius Anderson on its team. Through the lobbying and investment companies that he runs, Anderson has been paid fees ranging from $400,000 to $2.25 million as a placement agent for Stockbridge to secure millions in investments from both CalPERS and the California State Teachers Retirement System in the past five years.

(Following an investigation of placement agents by the New York Attorney General's Office, Anderson recently paid a $500,000 settlement that does not admit guilt or wrongdoing; he was also named in a lawsuit that alleges that he “received, paid, or arranged kickbacks on investment business from the State of New Mexico.”)

Financial maneuvers aside, the Treasure Island project has made steady progress. In January 2006, Treasure Island Community Development released updated drawings of the building plan, which adopted green and smart-growth planning concepts. It has won several environmental awards and gained the backing of some who had been skeptical.

“I think the current plan is quite solid,” said Moore, the citizen’s advisory board member.

The Bay Bridge is another massive public works project that was originally built in the 1930s as Treasure Island was starting to take shape.

Photo: Treasure Island Museum

As seen in 2007 from the southeastern shore of Treasure Island, the old Bay Bridge, the new one under construction, the modern container Port of Oakland in the background, and the future of air travel soaring overhead!

Photo: Chris Carlsson

A breakthrough in the plan finally came at the end of 2009, when the Treasure Island authority secured an agreement with the U.S. Navy for rights to the land. Though the city originally hoped to gain a no-cost conveyance, two bills before Congress that would have made it possible failed.

A Navy representative said the most recent bill would have created “potential windfalls” for communities with high-value property and for private-sector developers.

Instead, under the current terms, San Francisco agreed to make a $55 million payment to the Navy, followed by an interim payment of an additional $50 million.

The Navy will also share in potential future profits from the resulting development. This paved the way for the Mayor’s Office of Economic and Workforce Development to present legislation related to the land conveyance, an updated development plan and a term sheet that lays out the scope and costs of the project to the Board of Supervisors. The term sheet was approved in May.

But there are additional hurdles to come before the project can be realized. Among them is getting a green bill of health; the draft environmental impact report will be released for public review July 12.

The signing of the legal papers could take a year, and Treasure Island Community Development hopes to finally break ground next summer.

Even if all goes according to plan, a remade Treasure Island will need careful tending after Newsom leaves City Hall—as soon as early next year if he is elected lieutenant governor in November. The job, for the first time in a decade, might then go to a critic of Brown or Newsom. “I think he was hoping it would happen in his tenure,” Treasure Island Development Authority project manager Michael Tymoff said of Newsom’s vision of seeing a new Treasure Island take solid form. “But the process of getting entitlements takes longer than you would wish. But it’s such a regionally significant project that it doesn’t matter who is in office.”

Opportunities for San Franciscans to shape Treasure Island as the development moves to the next stage have never been greater. Increased information on the messy development process has started to spark new conversation among San Franciscans on and off the island. The meetings of the Community Advisory Board and Treasure Island Development Authority are open to the public. The release of next month’s environmental impact report will open a window into a multibillion-dollar project that promises to permanently alter the face of San Francisco.

A version of this article was published in the summer 2010 pilot edition of the San Francisco Public Press newspaper. Read select stories online.